Your Future SIPP

Your SIPP of Choice

An award winning product designed to provide you with all the choice and flexibility required from a SIPP, making it the only SIPP you will need both pre and post retirement.

How to apply

The leading flexibility and breadth of investment options offered by Your Future SIPP can make it a complex proposition for clients to ensure they get the most from it. We recommend that clients use the services of a professional, FCA-regulated financial adviser and Discretionary Fund Manager (DFM) or investment adviser.

We do not offer advice on – or judge the suitability of – SIPPs or their investments.

If you are a client and you do not have an adviser, we strongly recommend that you seek financial advice. You can find an adviser by visiting www.moneyhelper.org.uk.

Investment options

Unparalleled flexibility and choiceYour Future SIPP gives you and your adviser access to a huge range of investment platforms, brokers and wealth managers. Access to a wide range of investment and retirement solutions allows you to hold a variety of investments within the same pension. This is much more flexible than many types of personal pension, with the added advantage of fixed fees which are increasingly competitive as your pension fund grows.

Your Future SIPP also offers access to our market leading commercial property proposition, where we already look after over 8,890* commercial properties across the UK.

Our Fees

Clients only pay for what they useWe understand that transparency and affordability are important to you. That’s why we offer a menu-based fee structure, so you will only pay for what you use.

You can find our Schedule of Fees below.

Key Features

In creating Your Future SIPP we have listened to our clients and advisers and included as standard the key features that matter most to you.

- Access to Curtis Banks’ high quality administration

- Direct access to commercial property, including borrowing, succession planning and part/joint purchase

- Auto adviser charging

- Access to nearly all UK platform, broker and discretionary fund managers

- No minimum investment

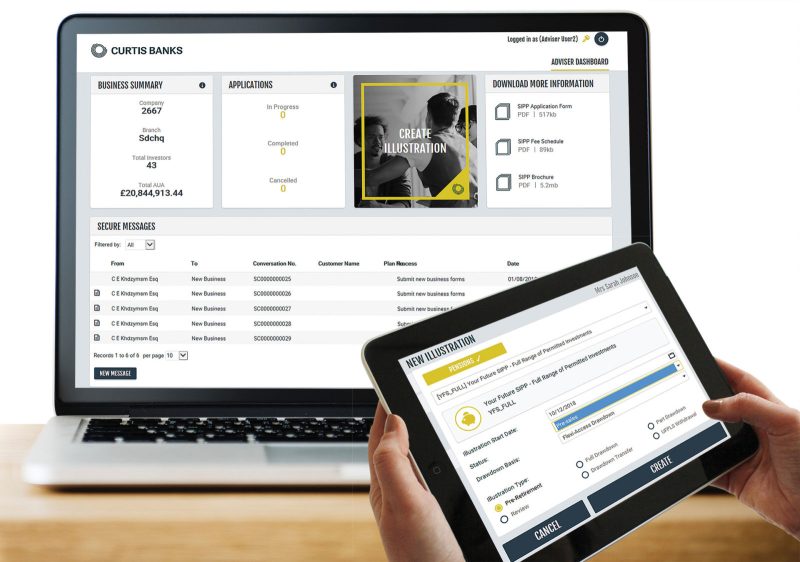

- Modern, functional online portal, completely responsive to any device to access on the go

- Full suite of retirement options allowing clients to take advantage of the pension freedoms flexibility

- Fully consolidated annual statement

Our online portal is completely responsive to any device to access on the go, and we continue to deliver a scheduled program of additional functionality, to continually enhance your user experience.

Contact us

Via our portal

Please send us your forms and instructions securely by using our convenient and encrypted messaging feature on the Curtis Banks portal.

Access PortalVia email

If you'd like to send us an email, please search our Contact page to find the relevant contact details.

Contact PageVia phone

If you'd like to speak directly to a member of our team you can call us on 0370 414 7000

Call us